Why the Mega Backdoor Roth 401 (K)’s Mega Features & Benefits Appeal to Tech Professionals

EQUITY COMPENSATION ADVICE | GUIDANCE | INSIGHTS | OBSERVATIONS

The Roth IRA is a powerful retirement tool that allows investors to create a tax-free stream of income. It’s become such a part of our everyday language that it’s listed in Webster’s dictionary.

The same can be said for the Mega Backdoor Roth. It might sound like a pro wrestler’s signature move, but you shouldn’t dismiss the opportunity that this strategy can provide just because the name is a little extra.

First, though, a quick primer:

What is a Roth IRA?

The Roth IRA was created to help Americans save for retirement in a tax-advantaged way. People contribute to their Roth IRAs with their taxed income, which then grows tax-free.

In contrast, a Traditional IRA allows people to deduct their contributions against their taxable income. The money then grows tax-deferred, meaning they won’t pay taxes on capital gains and dividends, but will pay taxes when they withdraw the funds in retirement.

What Are The Main Advantages Of A Roth IRA?

The Roth IRA is a great program and offers powerful tax advantages, as well as the opportunity to grow your retirement funds in the market for decades, never paying any taxes on the income and the gains once you reach retirement age.

What Are The Restrictions of A Roth IRA?

Income rules restrict who can contribute to a Roth: if your income is above $153k as a single filer, or $228k for married filers, then contributing becomes trickier. There are also maximum contribution limits – in 2023, it is $6,500 ($7,500 if you’re age 50 and older).

Most of our clients are actively saving into their workplace 401(k), and wonder what else they can do to move closer to their financial goals. Being able to withdraw tax-free in retirement is a huge attraction to many – and if you like the idea of a Roth, then you’ll love the supersize version: the Mega Backdoor Roth.

This strategy allows individuals, including tech professionals, to contribute additional after-tax funds to their employer-sponsored 401(k), and subsequently convert those contributions into a Roth IRA. It’s a smart way to get a lot of money into a Roth IRA for those who have the funds to put into savings.

Who Has Access To A Roth IRA?

Due to strong demand, tech firms have added the features needed for a Mega Backdoor Roth strategy to their 401(k) plans. Employees from leading tech companies, like Amazon, Apple, Cisco, Google, Intel, Meta, Microsoft, PayPal, and others have access to this strategy, and many of their employees make (mega) good use of it.

What Are the Main Features and Benefits Of A Roth IRA?

If you’re lucky enough to have access to the strategy – and it’s a big if – the Mega Backdoor Roth offers:

Higher Contribution Limits:

The Mega Backdoor Roth 401(k) enables you to contribute significantly more than the traditional annual 401(k) contribution limits, greatly increasing your total contribution.

As an illustration, let’s say 35-year-old Soozi earns $200,000 annually and contributes the pre-tax limit of $22,500 in 2023. Soozi’s employer also matched her contributions by 6% of her salary, adding $12,000. That brings Soozi’s total pre-tax contributions for that year to $34,500. Because the total limit is $66,000, Soozi can still contribute an additional $31,500 in after-tax dollars.

Tax-Free Growth:

Contributions made to a Roth 401(k) and subsequently converted to a Roth IRA are made with after-tax dollars. This tax-free growth potential can provide significant long-term benefits for tech professionals, considering the potential for their investments to appreciate over time.

Diversification of Retirement Assets:

By utilizing the Mega Backdoor Roth 401(k), tech professionals can diversify their retirement assets across different tax treatments. Traditional 401(k) and IRA contributions are typically tax-deferred, meaning they are taxed upon withdrawal in retirement. By contributing to a Roth 401(k) and converting it to a Roth IRA, tech professionals can create a pool of tax-free assets to complement their tax-deferred retirement accounts, offering more flexibility in managing their tax liability in retirement.

Flexibility in Retirement Withdrawals:

Roth IRAs offer more flexibility when it comes to withdrawals in retirement. Contributions made to a Roth IRA can be withdrawn tax-free and penalty-free at any time, even before reaching retirement age. While it’s generally advisable to let retirement savings grow until retirement, this flexibility can be beneficial for tech professionals who may anticipate different financial needs or experience unforeseen circumstances in the future.

But creating a Mega Backdoor Roth is mega complicated, with lots of nuts, bolts, and moving parts. And there’s always the potential to get nailed by unexpected tax bills. So consult with a financial planner or tax pro before trying this at home.

What do You Need for a Mega Backdoor Roth Strategy to Work?

There are four boxes you need to tick for the strategy to work:

Your 401(k) Allows After-Tax Contributions.

Within a 401(k), money can be held in different “buckets”. Pre-tax or traditional contributions are one bucket, after-tax/post-tax contributions are another bucket, and a Roth 401(k) portion is a third bucket.

This checkbox is pretty straightforward: either your employer plan allows for an after-tax “bucket”, or it doesn’t.

Your 401(k) Offers In-Service Rollovers or In-Plan Conversion.

These are two different ways to move money: an in-service rollover allows you to take money out of your 401(k) while you are still employed by the company and put it into an outside account, and an in-plan conversion lets you move money from one “bucket” to another within the 401(k). Your HR department or Plan Administrator will be able to tell you if in-service distribution is available to you.

If your plan doesn’t allow in-service rollovers to a Roth IRA or in-plan conversion to a Roth 401(k), then your opportunity to utilize the Mega Backdoor Roth is delayed until you leave your job. If that’s the case, you might want to reconsider this strategy, for reasons we’ll discuss in a moment.

Your 401(k) Lets You Move Your After-Tax Money ASAP

Ideally, executing the Mega Backdoor Roth means maxing out your regular 401(k) contributions, then putting all of your after-tax savings into the “after-tax” bucket of your plan. Then, you must get your money out of that bucket and into either a Roth IRA or Roth 401(k), before it starts accruing investment earnings – so almost immediately.

Why? The “after-tax” bucket is a tax-deferred bucket. Your contributions are post-tax, but the earnings aren’t, so you’re going to eventually owe tax on the growth. But once that money is in a Roth, it grows tax-free.

TAX-DEFERRED

TAX-FREE

The point is to get as much money into the Roth bucket as soon as possible to get as much tax-free growth as you can.

If your after-tax contributions do accumulate investment earnings, the IRS has said it’s OK to split up that money, by rolling your after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA. That means your contributions will still grow tax-free, and your investment earnings will grow tax-deferred.

Spare Cash

It’s worth repeating that a mega backdoor Roth IRA is really for folks who have money to put aside for savings, even after maxing out your 401(k) and Roth IRA contributions.

In general, it makes sense to first max out a regular or Roth 401(k) and a Roth IRA, if you’re eligible. Here’s why: With a regular 401(k), you get an upfront tax break — your taxable income is reduced in the year you make your contributions, and you defer taxes on your investment earnings until you make a withdrawal. If you opt for the Roth 401(k), you contribute money that you’ve already paid taxes on. Your tax break is delayed, but your money grows tax-free and you get tax-free income in retirement.

If you’re below the income limits for a Roth IRA, it’s better to contribute directly than to jump through all the hoops required for the Mega Backdoor Roth IRA. If you’re above the Roth IRA income limits, then the non-mega kind of Backdoor Roth is also an option.

What Is the Main Risk of Using a Mega Backdoor Roth?

The only real risk is that you’ll be putting large amounts of capital away into your retirement account, where you won’t be able to touch it for a long time without penalty.

Check your plan rules and provisions.

It’s important to note that the availability of the Mega Backdoor Roth 401(k) strategy depends on the specific plan rules and provisions offered by your employer. Not all employers offer this option, so to check if it’s available to you, review your plan documents or consult with your employer’s benefits administrator.

It’s a lot of hoops to jump through, but the opportunity to grow your retirement funds in the market for decades, never paying any taxes on the income and the gains once you reach retirement age, can’t be overstated.

Why? It comes down to how we feel taxes are heading.

Before we get into it, here’s the reality:

- The US is in $32 trillion of debt

- The US is running on a $1.7 trillion deficit

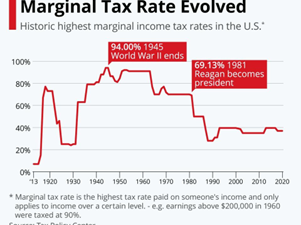

- The current US tax is VERY low, relative to history

- The US debt to GDP is 128%.

There are a few things our government can do to improve our current situation, and tax revenue is a big one. Given these facts, one can’t help but expect tax rates to go up in the future, and if they do, the billions and billions of retirement funds in pre-tax 401(k)s would be a prime target for tax revenue. This is why we are big advocates for not just having a diversified portfolio, but also to diversify your tax liability.

Historic highest marginal income tax rates in the U.S. Source: STATISTA

Why Diversify Your Tax Liability?

If all your retirement funds are in a pre-tax 401(k), and the day you retire, a new administration or Congress decides that income tax will now start at 30% and go as high as 50%, your only real option is to take the hit.

In contrast, if you allocate a portion to the pre-tax bucket and a portion to the Roth bucket, you could have more control of your tax responsibility and choose what retirement account you’d like to withdraw from based on tax rates. If taxes are high, maybe you spend more from the Roth and pay no income tax in retirement. If taxes are low, then maybe we pull more from the pre-tax retirement accounts.

This is why, if you can, you should allocate a good portion of your retirement funds in the post-tax environment. While most of our tech clients understand the importance of Roth money, many of them are ineligible to contribute to the Roth IRA due to their income level, or would like to contribute more than it is allowed by the IRS.

We coach our clients to take advantage of their employer-sponsored plans and utilize the full power of the Mega Backdoor Roth 401(k).

Additionally, it’s well worth working with a financial advisor or tax professional who can guide you through the intricacies of the Mega Backdoor Roth 401(k) strategy and ensure that it aligns with your overall financial goals and circumstances.

If you have questions about your specific circumstances, or want to make sure you’re equipped with the guidance and advice to pursue your future with real confidence and clarity, please get in touch. I welcome the opportunity to chat with you.

To join WestStar’s email list and never miss an update, or to find out more about our offices and advisors, please scroll down.

I wish you every success in the future and hope to hear from you soon.

Kevin Chang

Disclosures: “Distributions from traditional IRAs and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59½, may be subject to an additional 10% IRS tax penalty. Converting from a traditional retirement account to a Roth retirement account is a taxable event. A Roth retirement account offers tax free withdrawals on taxable contributions. To qualify for the tax-free and penalty-free withdrawal of earnings, a Roth account must be in place for at least five tax years, and the distribution must take place after age 59½, or due to death or disability. Depending on state law, Roth accounts distributions may be subject to state taxes.”

“If you’re considering using the Mega Backdoor Roth strategy, be sure to understand the potential tax implications, and consider whether it makes sense in the context of your other financial goals.”

Kevin Chang

Financial Consultant

‘I help tech families and pre-retirees – those who are heavily compensated through employer stocks – make important decisions around their financial lives. I provide customized solutions and timely advice, using data and analytics to help them navigate the investment world in an efficient and tax-advantaged manner. My clients get to make the most informed decisions and so create the lives they want to live. They feel empowered, knowing they are making a lasting impact and creating generational wealth through their financial plan.’